Indian equity markets have come off their day’s high as investors went for profit-booking following the surge in early trade on account of measures taken by the central bank and the market regulator to curb speculative trading in foreign exchange derivatives and arrest rupee’s slide. Nevertheless, trade at D-street continues to remain in green territory amidst positive global cues, with benchmark indexes, Sensex and Nifty, trading with gains of over a quarter percent, comfortably cruising past the crucial 19,400 and 5,800 levels respectively. Meanwhile, broader indices showcasing degree of outperformance are trading with gains of over around half a percent. On the global front, taking cues from positive Asian shares, European market have also got off to a positive start after euro zone finance ministers decided to grant Greece a last substantial tranche of aid-but with strings attached.

Closer home, stocks from Metal, Auto and Oil & Gas counters were the weak pockets and have cut short bourses’ gains, while those from Consumer Durable, Health Care and Power counters are sustaining the uptrend of the bourses. Meanwhile, Sugar stocks have rallied after Government issued a notification to implement a hike in import duty on sugar to 15 per cent from 10 per cent as the world's top sugar consumer tries to prop up local prices which are falling due to ample and cheap global supplies.

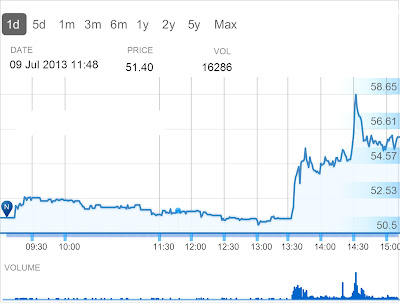

The BSE Sensex is currently trading at 19401.04, up by 76.27 points or 0.39% after trading in a range of 19486.00 and 19380.25. There were 23 stocks advancing against 7 declines on the index.

The broader indices were trading in green; the BSE Mid cap and Small cap indices were trading up 0.36% and 0.50% respectively.

The top gaining sectoral indices on the BSE were, Consumer Durables up by 2.25%, Health Care up by 1.52%, Power up by 1.21%, Capital Goods up by 1.12%, and Bankex up by 0.77%, while Metal down by 0.25%, Auto down by 0.11% and Oil & Gas down by 0.07% were the top losers on the index.

Out of the 30 share, 19 stocks were advancing while 11 were declining on Sensex. The top gainers on the Sensex were Sun Pharma up by 4.32%, Bajaj Auto up by 2.42%, NTPC up by 1.28%, Infosys up by 1.24% and BHEL up by 1.18%. On the flip side, Coal India down by 1.79%, Maruti Suzuki down by 1.17%, Tata Motors down by 0.94%, Mahindra & Mahindra down by 0.92% and Hindustan Unilever down by 0.74%, were the top losers on the Sensex.

Meanwhile, amid the talk of government increasing import duty on pulses and Commission for Agriculture Costs and Prices (CACP) suggesting 10% import duty hike on pulse import to boost domestic production, the Food Ministry has favoured a 7.5% import duty on pulses. The pulses imports have been permitted at zero import duty since 2006. CACP, which recommends support price for agriculture commodities, had recommended 10% import duty on pulses in its report on kharif 2013-14 crops.

The government is of the view that import duty hike is necessary at this point to protect the domestic production because imported pulses have become cheaper compared to domestic pulses, especially after the hike in the minimum support price (MSP). As per the industry data, traders are now importing tur pulse at Rs 3,300-3,500 per quintal from Myanmar, while domestic prices are ruling at Rs 4,300 per quintal.

Although India is the largest producer of pulses but it imports about three million tonnes of pulses every year to fulfill its domestic demand. In last few years, the government has made progress in increasing the pulses production through higher MSP, which boosts confidence of Indian farmers to produce more pulses.

The CNX Nifty is currently trading at 5,840.70, up by 29.15 points or 0.50% after trading in a range of 5,864.95 and 5,834.60. Out of the 50 share index, 35 stocks were gaining; top gainers of the Nifty were Sun Pharmaceuticals up by 4.59%, Power Grid Corporation up by 2.52%, Bank of Baroda up by 2.28%, Bajaj Auto up by 2.20% and IndusInd Bank up by 1.69%. On the flip side, Coal India down by 1.74%, Maruti Suzuki down by 1.32%, Mahindra & Mahindra down by 0.94%, Jindal Steel down by 0.79% and Tata Motors down by 0.78% were the major losers on the index.

Most of the Asian equity indices were trading in green; Shanghai Composite rose 0.35%, Hang Seng increased 0.28%, KLSE Composite jumped 0.27%, Nikkei 225 surged 2.58%, Straits Times gained 0.78%, KOSPI Composite added 0.74%and Taiwan Weighted was up by 1.08%.

On the flip side, Jakarta Composite declined by 0.28% was the lone loser amongst Asian pack.

European markets too got off to a positive start; with CAC 40 inching higher by 0.38%, DAX rising by 2.08% and FTSE 100 advancing by 0.44%.