New capital infusion by the government will be value accretive, said RK Saraf, chief financial officer and deputy managing director, SBI in an interview with business news channel.

New capital infusion by the government will be value accretive, said RK Saraf, chief financial officer and deputy managing director, SBI in an interview with business news channel."We need to maintain core Tier I capital at 9% and overall capital 12%," Saraf said.

Government stake would have to go down to 58% for additional Rs 90 billion.

Saraf said rate transmission will not take place linearly as it is a function of multiple aggregates.

"We expect loan demand to remain moderate,'' Saraf said. However, he expects bank to grow slightly above industry average.

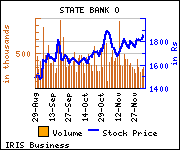

Shares of the bank gained Rs 1.3, or 0.07%, to trade at Rs 1,855. The total volume of shares traded was 49,564 at the BSE (10.30 a.m., Friday).

No comments:

Post a Comment